south carolina inheritance tax 2019

Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes. Primary residences in South Carolina are taxed at a rate of 4 their value.

Established by Congress in 2010 as part of a broader tax compromise portability allows a surviving spouse to use a prior deceased spouses unused estate tax exemption.

. This site will help. Washington States 20 percent. And personal property is taxed at 105 of income tax depreciated.

- 28 -. What are the estate taxes in South Carolina. Property owned jointly between spouses is exempt from inheritance tax.

Whats New for 2019 for Federal and State Estate Inheritance and Gift Tax Law. This doesnt eliminate other expenses related to estate planning expenses such as. South Carolina taxable income of estates and trusts is taxed either to the fiduciary or to the beneficiaries in the same manner as federal Income Tax purposes.

Easy Fast Secure. Ad Honest Fast Help - A BBB Rated. Currently South Carolina does not impose an estate tax but other states do.

Do Your 2021 2020 any past year return online Past Tax Free to Try. Unlike some other states there are no. South Carolina Inheritance Law Resource.

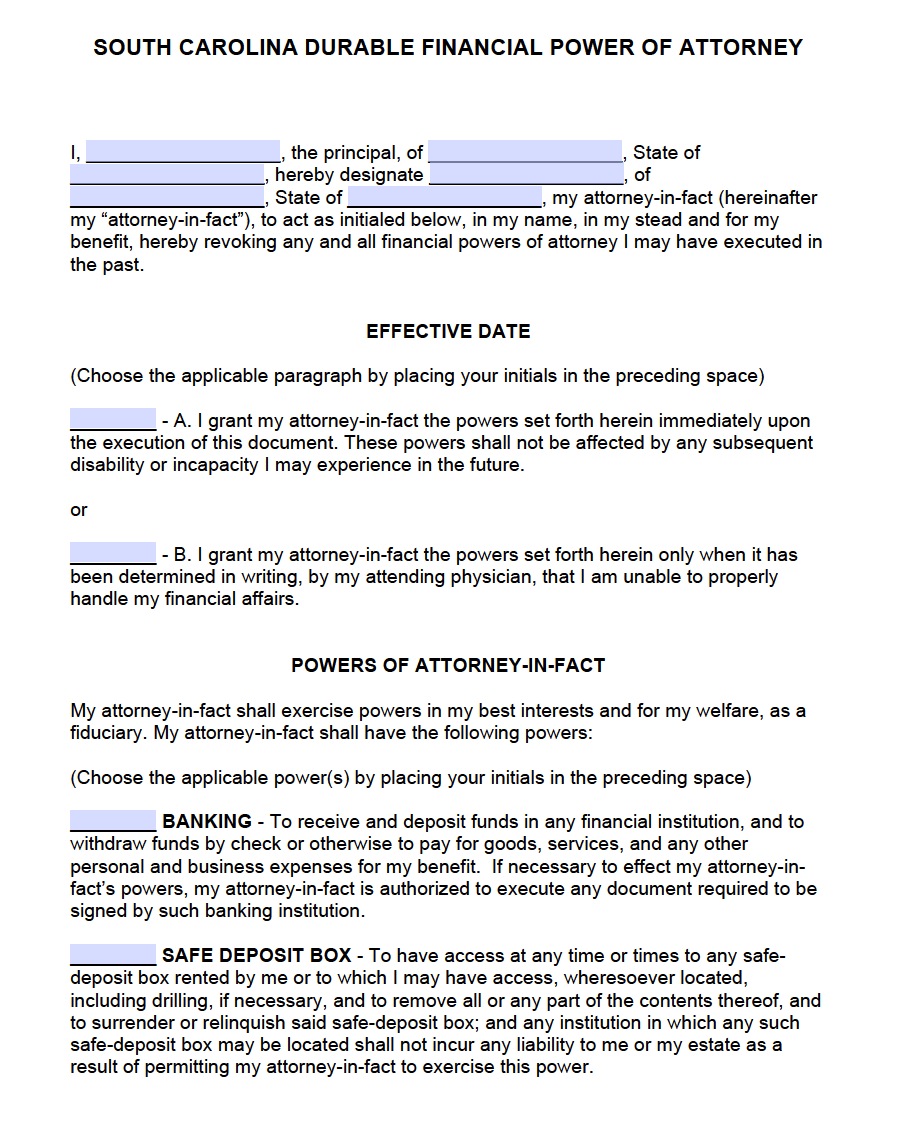

Ad Do Your 2021 2020 2019 2018 Taxes in Mins Past Tax Free to Try. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. South Carolina does not tax inheritance gains and eliminated its estate tax in 2005.

South Carolina does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone. Start wNo Money Down 100 Back Guarantee. Usually the taxes come out of whats given in the inheritance or are paid for out of pocket.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. It can be confusing to sort out the process the taxes and the issues that arise after someones death. November 2019 3 october 2019 2 september 2019 3 august 2019 4 july 2019 2 Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025.

Governor Henry McMaster recently signed a bill allowing for the creation of a statewide filing. South Carolina has no estate tax for decedents dying on or after January 1 2005. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets.

Inheritance tax payments are due upon the death of the decedent and become delinquent nine. SC residents need to know about Inheritance Law What South. IRS 2018 Estate and Gift Tax Update Source.

Easy Fast Secure. Agricultural property is taxed at 4 its use value. Maryland is the only state to impose both.

Ultimate Guide To Understanding South Carolina Property Taxes

South Carolina Israel Cooperation

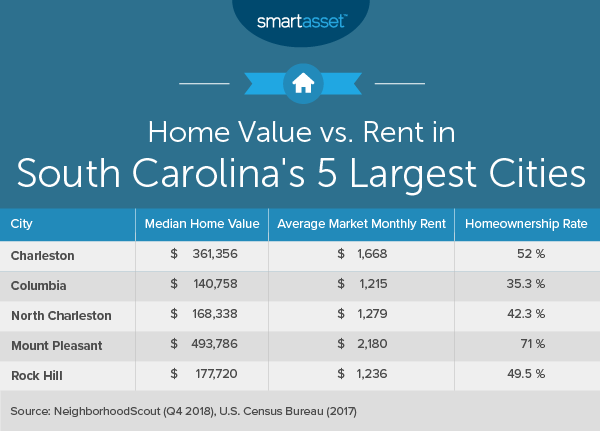

South Carolina Income Tax Calculator Smartasset

The Pros And Cons Of Retiring In South Carolina

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

2022 Best Places To Live In South Carolina Niche

Free Durable Power Of Attorney South Carolina Form Adobe Pdf

Cost Of Living In South Carolina Smartasset

See How South Carolina S Counties Are Growing And Shrinking Gem Mcdowell Law 843 284 1021 Estate Business Law Local

South Carolina And The 19th Amendment U S National Park Service

17 Things You Must Know Before Moving To South Carolina

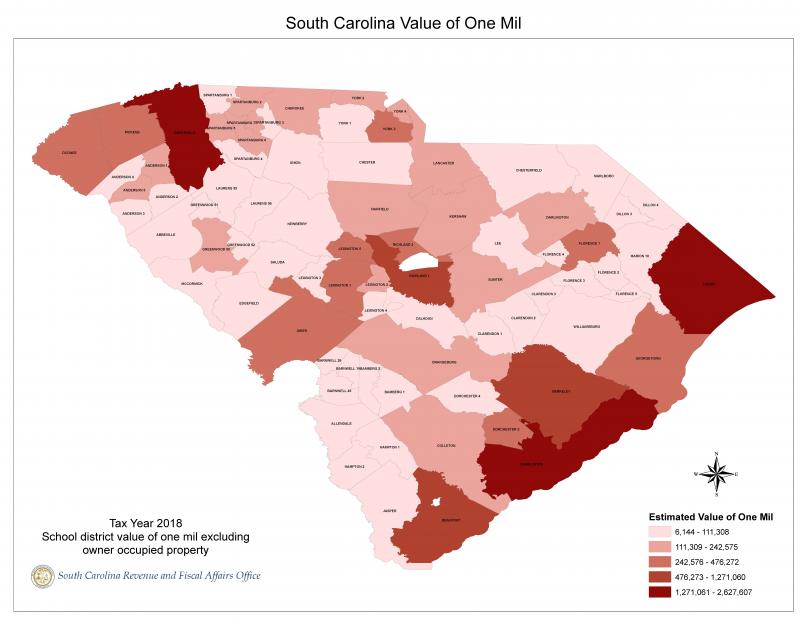

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office

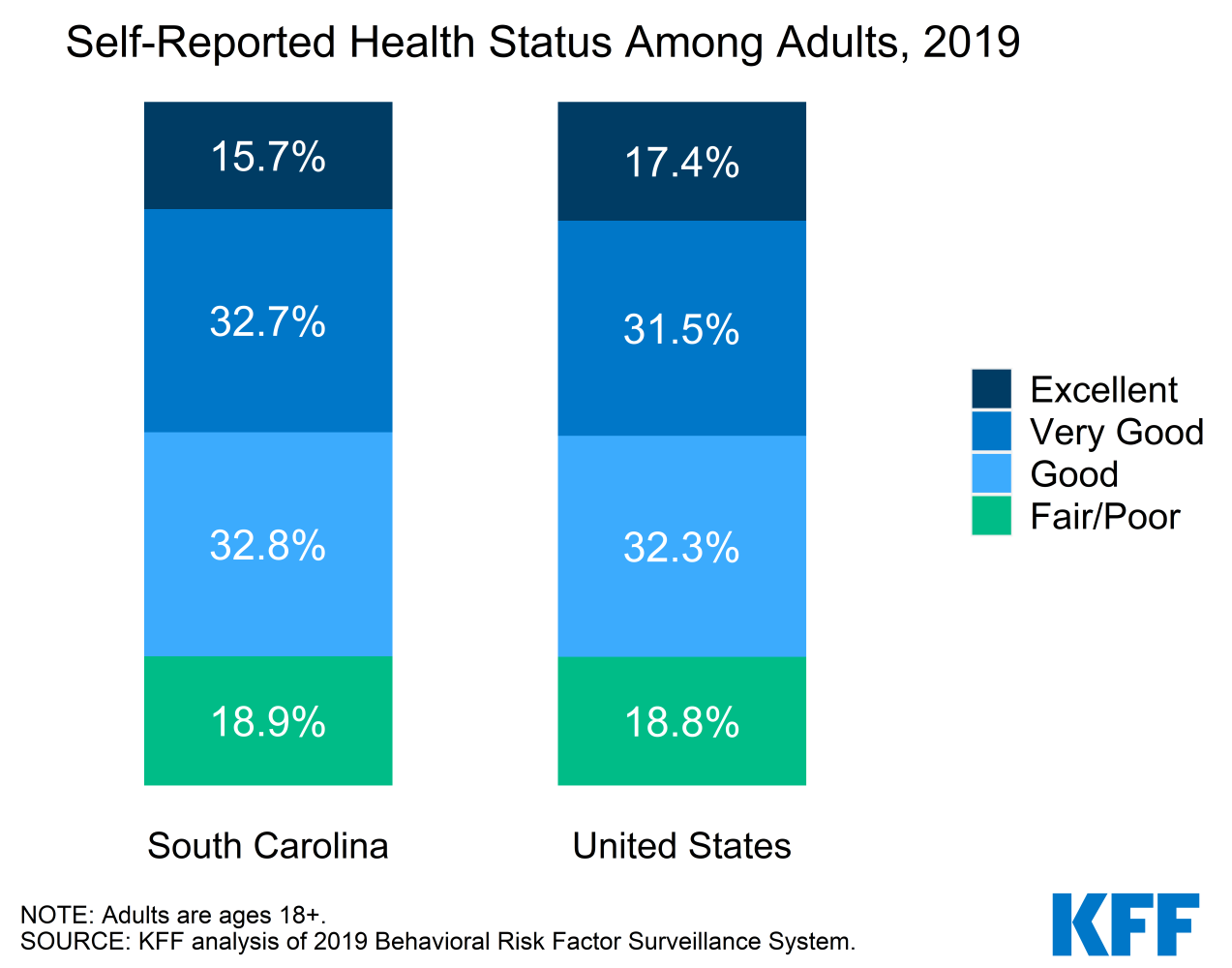

Election 2020 State Health Care Snapshots South Carolina Kff